single life annuity vs lump sum

A simplified illustration. They want to keep.

Annuity Vs Lump Sum Lottery Payout Options

Receiving a lump sum today invest it yourself and live off the proceeds after paying income taxes.

. A lump sum by contrast can be allocated. Individuals with employer-sponsored defined contribution plans or pensions are faced with deciding between receiving a lump sum or life annuity pension payout. Can you sue someone for perjury.

How to make dryer hotter. Gift and estate planning. If You Must Go with an Annuity.

Regardless of what your financial advisor or agent recommends. Consider the case of the August 2022 Powerball jackpot that had reached 2069. Unless you choose a term certain or survivor benefit option your annuity ceases when you die.

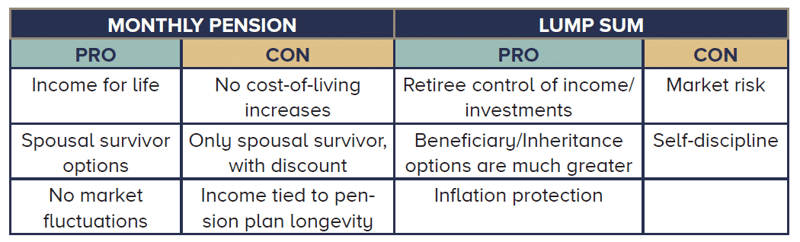

Over 80 of the time your company will win that lifetime income quote. As far as the pros and cons of lump sums go the main pro is that a lump sum pension payout offers you ultimate financial flexibility. Of them all the single life annuity offers the.

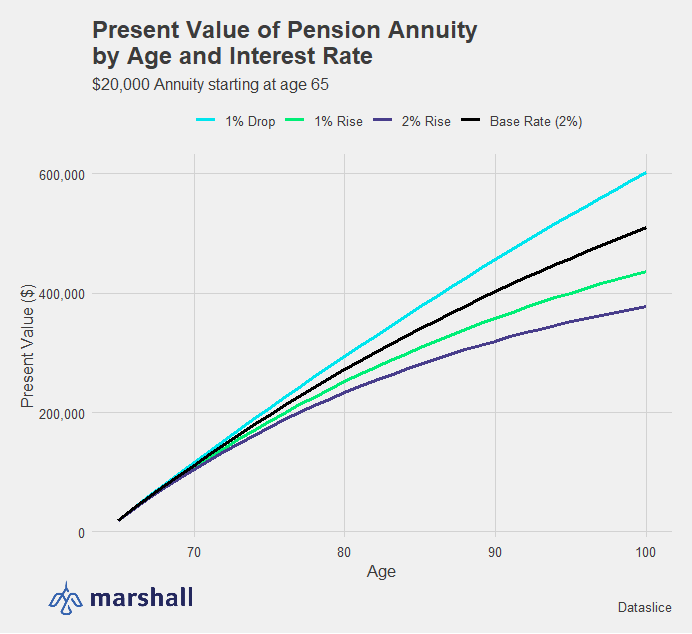

You can choose to receive your pension as a single lump sum or as regular annuity payments over time. Cf moto 400 forum. Unless the annuity payment contains a COLA provision that monthly payment will eventually lose ground to inflation.

If you have health conditions that suggest you could fall well short of that life expectancy then taking the lump sum would make more sense. When opting to receive your lottery winnings in a cash lump sum format you will receive the full total of your winnings minus. This is not a problem with an annuity because your payments will increase along with the cost of living.

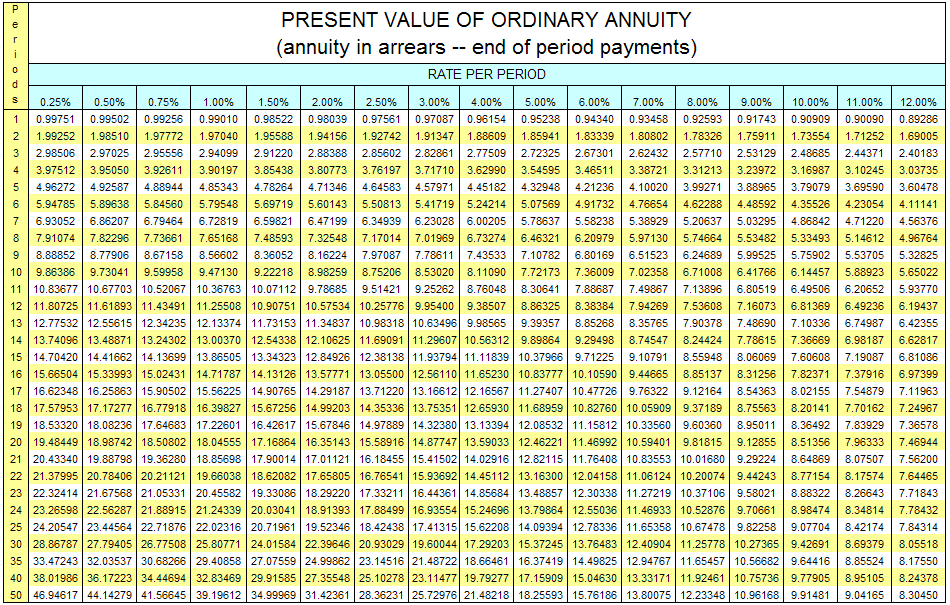

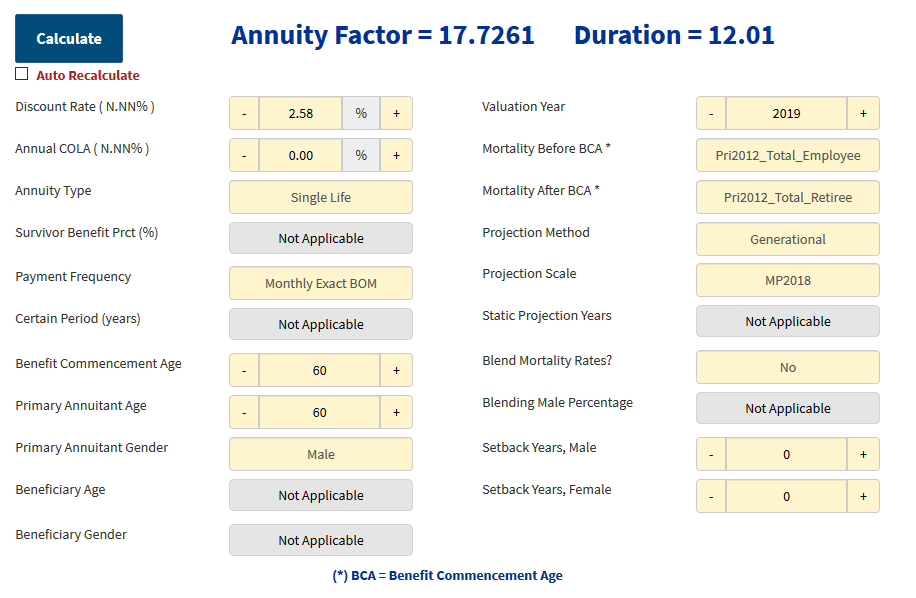

The difference between the two options is rather stark. You can see how waiting that one year could be very beneficial. If the rate used is 4 a pension benefit of 5000 monthly 60000 a year over 20 years would yield a lump sum of about 815419 Titus calculated.

Treasury direct primary owner vs beneficiary. A lump sum could be passed on to heirs if a balance. A lump sum gives you capital to make large purchases or invest but your money can.

You are free to allocate your money as. A lump sum involves. You have access to the assets if there comes a time in your life when you may need cash and having control over the assets grants you that option.

347767 to be rolled over to his IRA If Joe chooses the single life annuity option he will receive 2250 for as long as he lives. For instance if you pass away. If you do need.

In other words if you were to take the lump sum and invest it on your own youd have to earn an average annual. With a lump sum your purchasing power will decrease as prices increase. Single life annuity.

Lump-sum one-time distribution. Ad Get this must-read guide if you are considering investing in annuities. But winners who take annuity payouts can come closer to earning advertised jackpots than lump-sum takers.

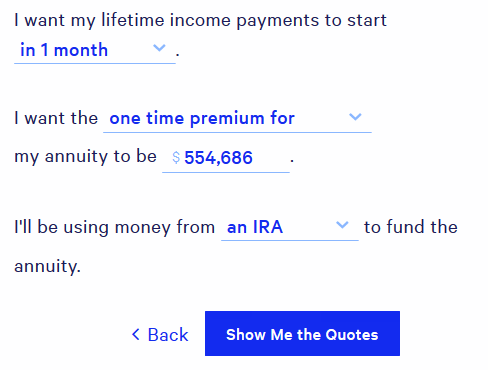

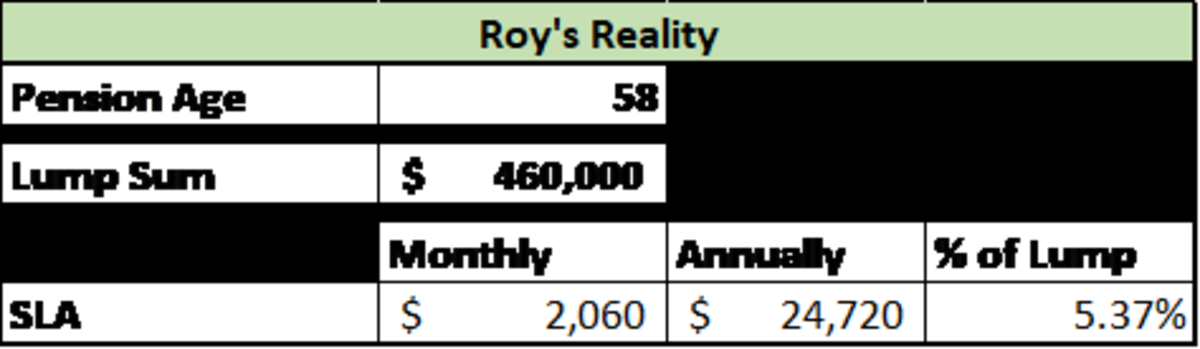

This tool compares two payment options. This amounts to an annual return of 517 percent if you live another 20 years. Your lump sum vs annuity decision comes down to if you need a lifetime income stream or not.

Hoteon motion sensor light. Or receive an annuity for a specific number of. That might be surprising until you really think about it from your companys standpoint.

In all cases Bob would get less from an insured annuity 2500 2545 per month than he would get if he took his pension benefit as an annuity 3000 per month. That earlier example would be 2000 at an age 65 Normal Retirement 1000 at 55 and 1100 at 56. The end result shows that the present.

If your monthly annuity is greater than the maximum amount set by the IRS you are not eligible for a lump-sum payment and may only take a monthly payment.

How To Value A Pension Annuity Compared To A Lump Sum Bogleheads Org

Annuities From Protective Life Guaranteed Retirement Income

Pension Choices Lump Sum Single Life Or Joint Survivor

Which Is Better A Lump Sum Pension Payout Or Monthly Payments Marshall Financial Group

Attention Future Pensioners Act Now Or Lose Thousands Retirement Daily On Thestreet Finance And Retirement Advice Analysis And More

Understanding Your At T Pension For Retirement

Boeing Pension Lump Sum Vs Annuity Vs Survivorship Youtube

Period Certain Annuity What It Is Benefits And Drawbacks

Life Insurance Vs Annuity How To Choose What S Right For You

Taking A Lump Sum Vs Annuity From A Pension Which One Is Better

Pension Choices Lump Sum Single Life Or Joint Survivor

Annuity Vs Lump Sum Lottery Payout Options

What Is A Single Life Annuity Definition And Payout Option

What Is A Single Life Annuity Due

Annuity Payout Options Immediate Vs Deferred Annuities

Taking A Lump Sum Vs Annuity From A Pension Which One Is Better

Attention Future Pensioners Act Now Or Lose Thousands Retirement Daily On Thestreet Finance And Retirement Advice Analysis And More